- Founded in January of 2003

- Registered capital : 50.4tn KRW (As of December 31, 2022)

- Legal representative : Lim, Dongsoon

- Principle Shareholders & Percentage: NH Financial Group(60%) + Amundi(40%)

NH-Amundi Asset Management's Vision

The vision of NH-Amundi Asset Management is "Your Trusted and Responsible Global Investment Partner"

With the main slogan "NH-Amundi, an asset manager to respect clients and to be trusted by clients", we promise to faithfully fulfill our role as an asset manager that can give trust to clients.

당신의 꿈과 미래를 함께하는 NH-Amundi / Your Trust is our Pride - NH-Amundi 자산운용

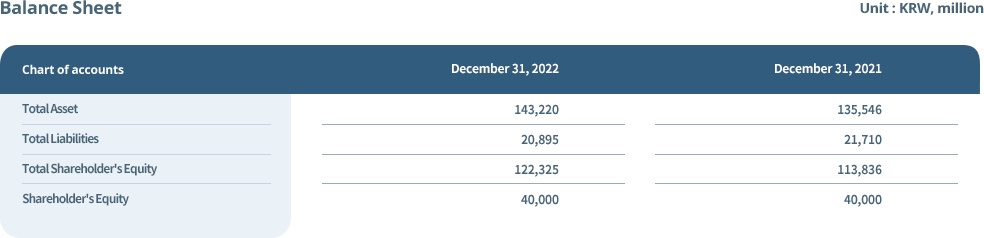

| Chart of accounts | December 31, 2022 | December 31, 2021 | December 31, 2020 |

|---|---|---|---|

| Total Asset | 143,220 | 135,546 | 125,497 |

| Total Liabilities | 20,895 | 21,710 | 19,691 |

| Total Shareholder's Equity | 122,325 | 113,836 | 105,806 |

| Shareholder's Equity | 40,000 | 40,000 | 40,000 |

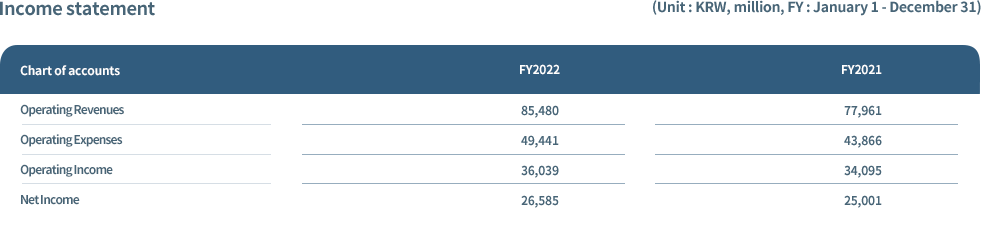

| Chart of accounts | FY2022 | FY2021 | FY2020 |

|---|---|---|---|

| Operating Revenues | 85,480 | 77,961 | 65,249 |

| Operating Expenses | 49,441 | 43,866 | 37,658 |

| Operating Income | 36,039 | 34,095 | 27,590 |

| Net Income | 26,585 | 25,001 | 20,458 |

- 2003.01

- Founded as 'NACF-CA Investment Trust Management Company' as a joint venture between NACF

- 2003.08

- Launched Korean equity fund (First tax-exempt long-term equity fund)

- 2005.12

- Launched global equity fund (Korea-Japan fund)

- 2007.08

- Changed name to NH-CA Asset Management

- 2009.06

- Launched Korea's first Publicly offered leveraged fund

- 2010.01

- Credit Agricole AM rebranded as Amundi Asset Management

- 2012.03

- NACF rebranded as NH Financial Group

- 2014.09

- Launched Korea's first KTB 10-year Index fund

- 2015.10

- Started alternative investment business

- 2016.05

- Changed name to NH-Amundi Asset Management

- 2018.03

- Started HANARO ETF business

- 2018.11

- Started private hedge fund business

- 2018.12

- Adopted the stewardship code

- 2019.08

- Launched Victorious Korea fund

- 2020.09

- Launched Green Korea fund

- 2021.03

- Established the ESG Committee Announced the ESG vision, "ESG First"

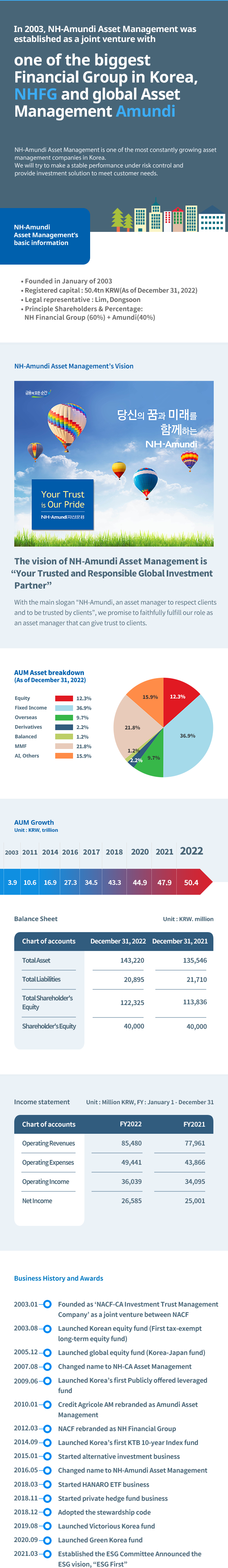

In 2003, NH-Amundi Asset Management was established as a joint venture with one of the biggest Financial Group in Korea, NHFG and global Asset Management Amundi. NH-Amundi Asset Management is one of the most constantly growing Asset Management companies in Korea. We will try to make a stable performance under risk control and provide investment solution to meet customer needs.

- Founded in January of 2003

- Registered capital : 50.4tn KRW (As of December 31, 2022)

- Legal representative : Lim, Dongsoon

- Principle Shareholders & Percentage: NH Financial Group(60%) + Amundi(40%)

NH-Amundi Asset Management's Vision

The vision of NH-Amundi Asset Management is "Your Trusted and Responsible Global Investment Partner"

With the main slogan "NH-Amundi, an asset manager to respect clients and to be trusted by clients", we promise to faithfully fulfill our role as an asset manager that can give trust to clients.

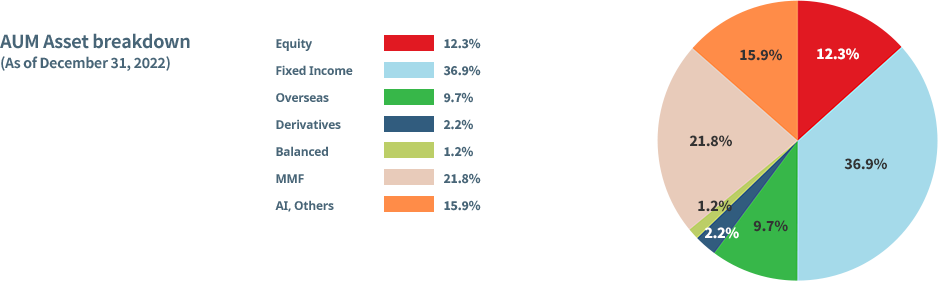

Equity 12.3% / Fixed Income 36.9% / Overseas 9.7% / Derivatives 2.2%/ Balanced 1.2% / MMF 21.8% / AI, Others 15.9%

In 2003, 3.9 / In 2011, 10.6 / In 2014, 16.9 / In 2016, 27.3 / In 2018, 34.5 / In 2019, 43.3 / In 2020, 44.9 / In 2021, 47.9 / In 2022, 50.4

| Chart of accounts | December 31, 2022 | December 31, 2021 | December 31, 2020 |

|---|---|---|---|

| Total Asset | 143,220 | 135,546 | 125,497 |

| Total Liabilities | 20,895 | 21,710 | 19,691 |

| Total Shareholder's Equity | 122,325 | 113,836 | 105,806 |

| Shareholder's Equity | 40,000 | 40,000 | 40,000 |

| Chart of accounts | FY2022 | FY2021 | FY2020 |

|---|---|---|---|

| Operating Revenues | 85,480 | 77,961 | 65,249 |

| Operating Expenses | 49,441 | 43,866 | 37,658 |

| Operating Income | 36,039 | 34,095 | 27,590 |

| Net Income | 26,585 | 25,001 | 20,458 |

- 2003.01

- Founded as 'NACF-CA Investment Trust Management Company' as a joint venture between NACF

- 2003.08

- Launched Korean equity fund (First tax-exempt long-term equity fund)

- 2005.12

- Launched global equity fund (Korea-Japan fund)

- 2007.08

- Changed name to NH-CA Asset Management

- 2009.06

- Launched Korea's first Publicly offered leveraged fund

- 2010.01

- Credit Agricole AM rebranded as Amundi Asset Management

- 2012.03

- NACF rebranded as NH Financial Group

- 2014.09

- Launched Korea's first KTB 10-year Index fund

- 2015.10

- Started alternative investment business

- 2016.05

- Changed name to NH-Amundi Asset Management

- 2018.03

- Started HANARO ETF business

- 2018.11

- Started private hedge fund business

- 2018.12

- Adopted the stewardship code

- 2019.08

- Launched Victorious Korea fund

- 2020.09

- Launched Green Korea fund

- 2021.03

- Established the ESG Committee Announced the ESG vision, "ESG First"