With our customers,

With the world,

NH-Amundi is

your reliable partner

by your side.

Download Company Brochure

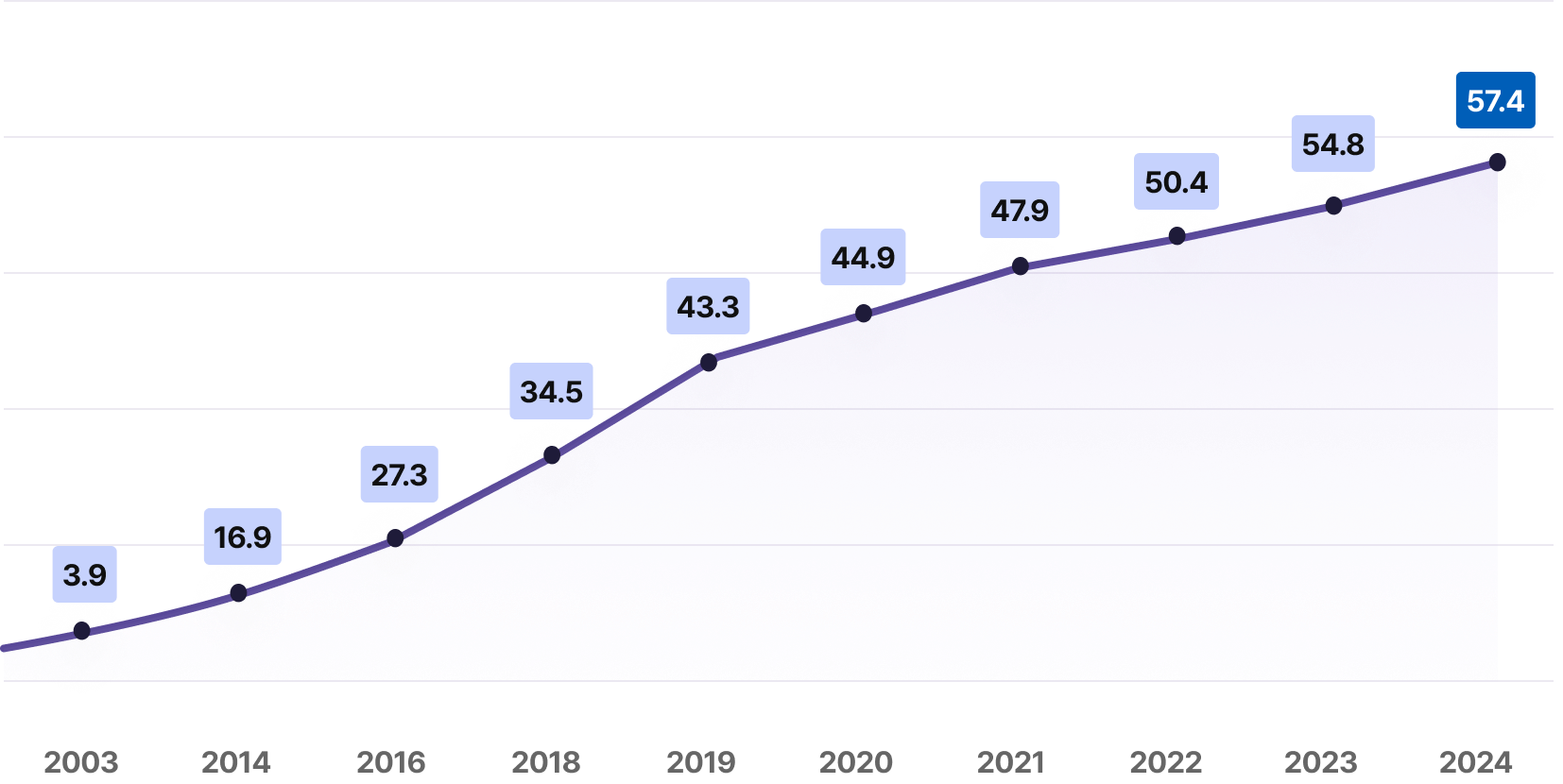

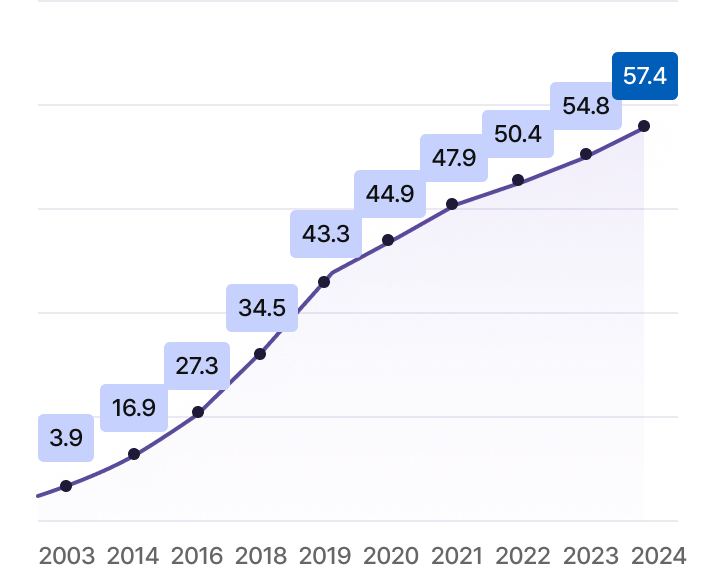

AUM

57.4 trillion KRW

Industry Ranking by AUM

7th

Company Establishment

January 28, 2003

Assets Under Management

Unit: Trillion KRW

- 2003

- 3.9

- 2014

- 16.9

- 2016

- 27.3

- 2018

- 34.5

- 2019

- 43.3

- 2020

- 44.9

- 2021

- 47.9

- 2022

- 50.4

- 2023

- 54.8

- 2024

- 57.4

* As of the end of 2024

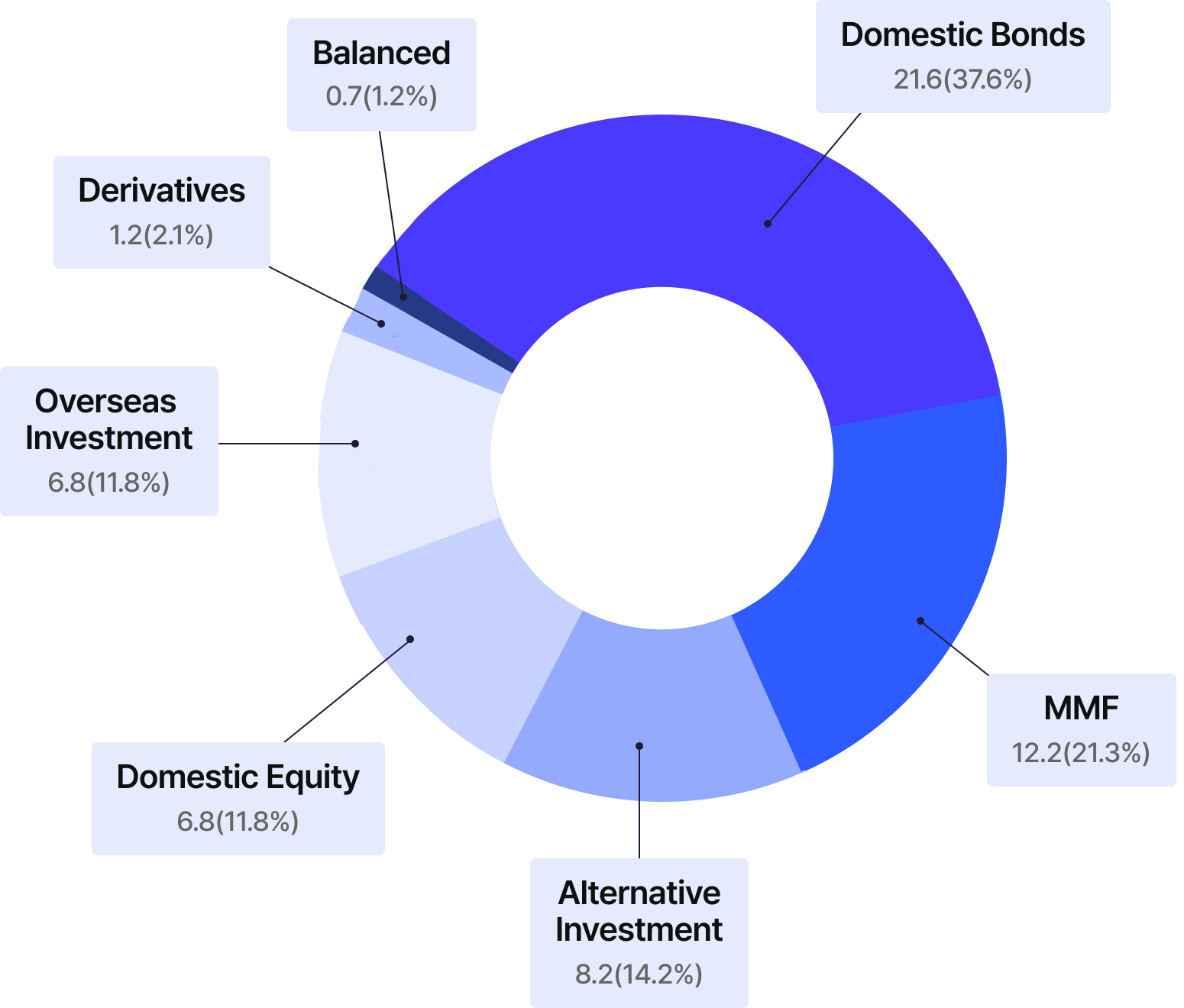

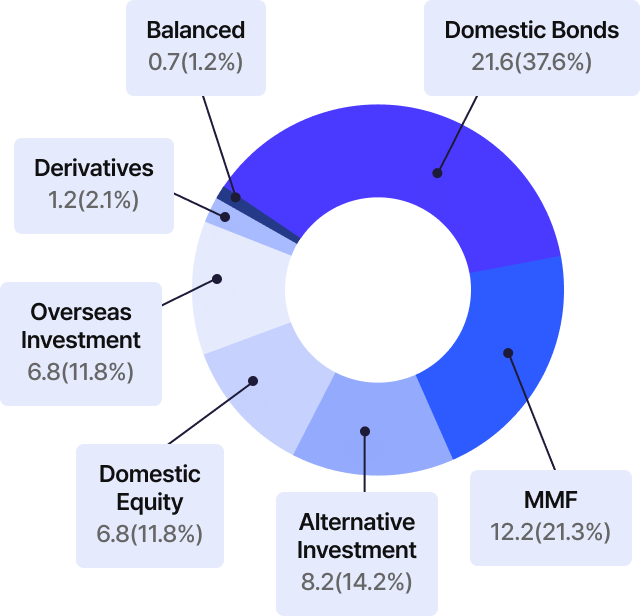

Product Composition Status

Unit: Trillion KRW

- Domestic Bonds

- 21.6(37.6%)

- MMF

- 12.2(21.3%)

- Alternative Investment

- 8.2(14.2%)

- Domestic Equity

- 6.8(11.8%)

- Overseas Investment

- 6.8(11.8%)

- Derivatives

- 1.2(2.1%)

- Balanced

- 0.7(1.2%)

* Assets Under Management (AUM) as of the end of 2024 : Based on total discretionary contracts, private and public funds.

This information is based on the time of the investment advertisement and may differ in the future.

Jung-Sup Gil

CEO of NH-Amundi Asset Management

A Message from the 11th CEO of

NH-Amundi Asset Management

Dear Valued Customer,

Welcome to NH-Amundi Asset Management!

With the support of our clients and shareholders, we grew successfully as a global joint venture asset manager to rank seventh in the industry with an AUM of 60 trillion won.

NH-Amundi Asset Management was established in 2003 as a model of global collaboration by Korea's Nonghyup (NH) and the French Credit Agricole (CA) based on the spirit of the cooperatives with the common goal to serve the farmers and the agricultural industry.

We were able to live up to the expectations of bo1th shareholders while putting our clients first and concentrating all our capabilities to ensure a sustainable growth with our clients.

I believe that the first and foremost role expected from an asset managing company would be to think from a client's perspective, generate stable profits, and return those profits to satisfy clients.

We at NH-Amundi will provide the best products and investment services based on outstanding management capabilities and differentiated competitiveness to meet your needs.

We will also make best use of the NH Financial Group's network which is the largest in the country as we learn from Amundi's culture and its advanced management capabilities that make Amundi the number one asset management company in Europe and number 10 globally to explore new investment opportunities and strengthen cooperation.

We will ensure all our businesses are stable by implementing a preemptive risk management and thorough internal control system.

In a market environment that constantly changes, we at NH-Amundi promise you to be your trustworthy global investment partner.

History

Development Period 2003 ~ 2014

Establishment of Fund Lineup

and Securing Growth Drivers

-

2003.01

- Joint venture between NongHyup Central Cooperative and CA Asset Management

- Launched as NongHyup CA Investment Trust Management

-

2003.08

- First Launch of Domestic Equity Fund (First tax-exempt long-term equity fund)

-

2007.08

- Company name change from NH CA Trust Management to NH-CA Asset Management

-

2009.06

- Launched Korea's First Public Leverage Fund

-

2010.01

- Credit Agricole Asset Management Relaunched as Amundi Asset Management

-

2012.03

- Separation of Credit and Economic Divisions of NongHyup National Agricultural Cooperative Federation

- Launch of NongHyup Financial Group

-

2014.09

- Launched Korea's First 10-Year Index Fund

Growth Period 2015 ~

Expansion into

New Businesses

and Diversification

of Fund Lineup

-

2015.10

- Start of Alternative Investment Business

-

2016.05

- Company name change from NH-CA Asset Management to NH-Amundi Asset Management

-

2017.07

- Amundi Asset Management's acquisition of Pioneer

-

2018.03

- Launch of HANARO ETF

-

2018.11

- Launch of Private Hedge Fund

-

2018.12

- Adoption of Stewardship Code

-

2019.06

- Launch of HANARO TDF

-

2019.08

- Launch of Victorious Korea Fund

-

2021.03

- Establishment of ESG Promotion Committee and Announcement of ESG Vision 'ESG First'

-

2022.03

- Launch of Good Earth OCIO Asset Allocation Fund

-

2023.06

- Launch of Signature OCIO Fund

Your Trusted and

Responsible

Global

Investment Partner

NH-Amundi

Asset Management

Summary Balance Sheet

Unit : Million KRW

| Category | End of 2024 | End of 2023 | End of 2022 |

|---|---|---|---|

| Total Assets | 162,972 | 150,195 | 143,220 |

| Total Liabilities | 22,842 | 20,600 | 20,895 |

| Total Equity | 140,130 | 129,595 | 122,325 |

| Capital | 40,000 | 40,000 | 40,000 |

Summary Income Statement

Unit : Million KRW / Period : January 1 – December 31

| Category | End of 2024 | End of 2023 | End of 2022 |

|---|---|---|---|

| Operating Revenue | 92,492 | 86,309 | 85,480 |

| Operating Expenses | 55,689 | 50,796 | 49,441 |

| Operating Income | 36,803 | 35,513 | 36,039 |

| Net Income | 29,998 | 26,555 | 26,585 |